Here I am sitting. On a train back home to Stockholm a friday night at 20:27. Most of my investments were made 2-3 years ago.

Sometimes you look like a genius. Sometimes you look like an idiot. This week, all my stocks have been performing really well. Chinese equities are up around 50~%, my swedish and american stocks keep performing well. Its what many asset managers would call ’a really successful week’. They would go flaunting to their friends ’look bro, im up x (money) on this right now, I told ya this stuff was hot’ or post some silly monthly development on instagram writing some cheesy inspirational quotes about how ’you can do it too, look at me, im so great.’.

It actually feels really silly. Because in truth, I didnt do anything special this week or month at all. Quite literally nothing.

The work I did, was done years ago. The work I am doing today, won’t have an impact until years into the future. It feels quite silly, that something completely beyond my control, should merit any praise or scorn.

Yet, a couple of months ago. I was the idiot. Chinese equities hit rock bottom, my swedish stocks and american stocks were yet to pick up pace. And I have to admit, I did feel quite beat down at that time also, even if I should only focus on what is within my own control.

There are few, if any, things I would change. The thoughts went like ’maybe I would buy slightly more of this’ or ’maybe I would buy slightly less of this’.

Doing nothing, doing much, doing good or doing bad, the field of finance and the field of investment management is so severly misunderstood, that people literally can’t tell if you are a good manager or not. Finance in general being one of the most obscure, misunderstood and understudied fields combined with one of the most common human fallacies; being too results oriented sincerely leads to disastrous results for society.

Most people looking at an investment manager, look solely at their results. Often quite shortsightedly, like last quarters or years. Let’s say a manager had CAGR 600% the last 2 years. But did ~5% in cumulative CAGR the 10 years before that, for let’s say 12 years. A manager with such a track record, can not be relied upon as being a “good asset manager”, yet (might be with more proof shown that it is not just variance or trend). Somehow, I would bet, that this guy would be wildly more popular than let’s say, a manager that had a CAGR of 5% the last 2 years but a cumulative CAGR of 20~% the 10 years before. Basically the opposite.

Don’t believe me? Just look at Cathie Wood and Warren Buffett. Cathie Wood had an insane runup during covid and was assigned ’stock genius’ bla bla bla so on so on. Written on the news, put on Fortune magazines and everyone wanted a piece of her. She opened a fund. Just google her. She was deified basically. Made into an “investment god”. It is just another example of another human fallacy; recency bias. Being biased to what happened recently, instead of what has been happening for a long time. And with that analogy, Warren Buffet has been “buffetting” for a long long time. I made up that word just now.

But any decent manager would instantly be able to tell that she had that astonishing year mostly from one stock: Tesla. Basically 40-60% of her portfolio, was Tesla.

Sure if you are able to ’predict’ the bull run Tesla had, you are destined to be a good asset manager. But what skill was there in predicting that? I sincerely believe that, those who made a lot of money on Testla where not investing, they were speculating. Tesla was valued at 70+ P/E, ridiculous prices at “financial crisis levels of expensive”. Sincerely, that was not skill, it was “a feeling, an instinct to trust in Elon Musk” type of analysis. A guy like that is the person to say something that sounds rational to the untrained ear, but is in actuality quite stupid upon further analysis. For example, “I mean come on bro, investing in Elon Musk is a no brainer. He is one of our generation’s biggest geniuses, the risk of him failing is very low”. This does sound like a compelling argument when put into words, but put into writing, it does seem a bit sillier.

First of all, being a genius and being successful, mainly correlates to the field you are a genius within and not to life in general. Isaac Newton, certainly a genius has a famous quote which goes “I can calculate the movement of stars, but not the madness of men”, which famously came from his disastrous stock market returns after trying his hands at technical analysis, advanced math and “chart reading”. Do I trust Isaac Newton with the laws of physics, yes I do. Do I trust Isaac Newton with the virtues of compounding, no I do not. Do I trust Elon Musk to revolutionize elecitrc vehichles, yes I do. Do I trust Elon Musk to allocate capital and return shareholder value like Warren Buffet? No I do not.

When assigning genius to someone it is important to add a “believability weight” to someone’s opinion. Simply being extremely competent within one field, does not make you an expert in another. Actually, the correlation is usually reversed. What I mean is that when someone is extremely good at one thing, it is actually quite common that they are terrible at many other things, to compensate their specialization into one field. Similiary, the best artists are usually not the best mathematicians and frankly speaking, the reverse is also true.

People often get this mistaken, taking the advice of a billionaire within all aspects of life. Or perhaps, never taking the advice of someone that would be viewed as “unsuccessful” through normal society lenses. A billionaire is terribly good at accumulating wealth, it does not necessarily correlate to being terribly good at living a meaningful life. Of course, it also does not mean that they are mutually exclusive, but it does mean, that merit is applicable only to the field where it is deserved. And not to other fields.

Anyways, back to Cathy Wood.

It is quite easy to see, that Cathy Wood got lucky. Because no rational person would bet that much money on a speculation. Now in the aftermath, she has fallen from her highs (as to be expected), and her fund that many retail investors got themselves into, got burnt along the way. This stuff, should really be illegal. A lot of people really got taken for a long loop. Its stupid, sincerely, and it is very hurtful to the global financial system. When these things happen, the richest people are rarely affected (rich people are the people who are the best at accumulating wealth within their own separate societies), since they have an edge in wealth management, otherwise they would not be rich. When these things happen, it mainly hurts the normal working guy, who, can’t afford to loose that kind of investing money.

It is scary, how little regulation and breaks are set in place in the modern financial system. How easy it is to “get burned” and how easy it is to loose money, if you do not navigate it correctly. I am not sure who suggested it, if it was Graham or Buffett, but the suggestion was that any stock purchase can not be sold within 5 years of purchase. And another suggestion was that all stock quotes should only update on a weekly basis, instead of a minute/ second basis like today.

These two simple “fixes” would dramatically lower volatility on all markets, completely eradicate speculation and return finance to pure investing, free from all stupid schemes like options and similiar financial degency. Surely many will argue that options do provide some financial advantage to the system, but I am of the opinion that the disadvantage far outweighes the advantage. With these two fixes the 2000s market crash probably would never have happened. And the 2008 and the recent 2021 crash would have been far milder (if they would have happened which I do not think), protecting the “normal guys” in the market.

Okay, back to Cathie Wood for the third time.

We have a similiar finance influencer in Sweden called ’100 miljoner mannen’, or 100 million man in english. He does not show his results in % returns, and only shows returns in amount of (kr). He basically made ALL of his money at the same time that Tesla started its bull run. Sincerely, he has extremely mediocre returns and was barely floating before Tesla ran. This is how his instagram page looks like:

There is sincerely no good information here and all of it are simple “money flexing”, or “I made x amount of money today” and similiar.

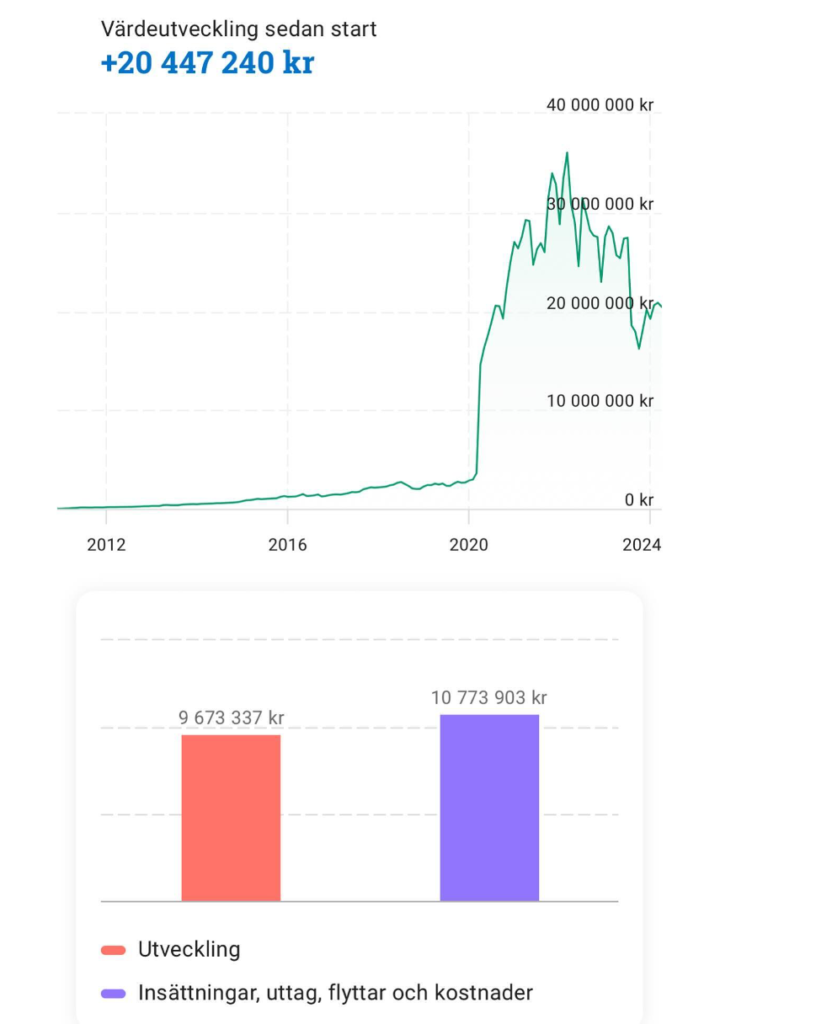

And this is his investment results:

We can basically see that he has put more money into this account than he has made from stock returns. According to him, he has made 300% since the start of his account, which if my math is correct (3^(1/12)=1.095)), which accumulates to about a 9.5% CAGR. This means he has barely beaten index for the last 10 years. And probably only beat it with a stroke of luck by investing into Tesla at 2020. If we see his development pre Tesla, he probably underperformed index by a far margin.

What I am more curious about this guy, is how he made that 10 million kr outside of the stock market.

Yet he ’inspires’ youth, he sells books, he has an AI bot trading in his name and so on. You get it, he is a finance influencer. But sincerely speaking, after a 10 year track record barely beating index, you might as well get an index if you are not hoping for a “Tesla lucky draw” at around year 7 to bump it up to average returns.

This is the problem. People get blinded by the big numbers, by the swings up and down, by our human fallacies; Results Orientation, Recency Bias and Authority bias.

Investing is all about % returns. Anything else is sincerely bullsh*t. When you hear a manager say ’I did x dollar/kr’ you can automatically disqualify them. They are not a good investor.

Luck and good investing is not really the same thing. And being big, is not the same as being good. That’s why we have weight classes (that’s a boxing reference). Stop being short sighted. See through and take a moment to think.

This post does not have a main point and I am just reflecting baselessly.

In a sense, I relate to those finance influencers although I quite sincerely despise them. Because I am too, not a good investor, yet. At least I have not proven myself to be one, and I would not say that I have the qualifications to be trusted yet.

So far, my 2 year track record is quite horrible, if you want to see it you can head over to my instagram where it is currently posted. Perhaps, they will still be bad in 5 years, when I have accumulated a 7 year track record. And if I reach 10 years, still barely beating index, I am going to seriously reconsider my career choices. Because barely beating index, how am I supposed to make a case for managing someone else’s money? Seems a very far stretch.

Either way, I hope to perform well and I would not regard myself as a quitter. Maybe it will take me 15 years, to accumulate my first 7 year good track record. Or maybe even 20 or 25 years. But I am sure, that with some more effort, with some more good lessons and sometimes painful lessons and of course.. With some luck, hopefully I can make this dream come into reality. That is why I am writing this blog after all.

Having mediocre returns sincerely scares me, but it is definitely possible. Being this honest and transparent, is kind of scary after all. It feels like the entire world can see through you. But then at the same time, it is oddly liberating. Nobody can say that I was not transparent, that I hid it somewhere or that my track record is fake. Because… Who would fake a track record as bad as mine? (lol, thats a joke, oddly based on reality though). Anyways, I do still believe in my own abilities, but investing is definitely not easy. And I still have so much to learn.

For those of you reading this and following me now, right from the get go of my career. I hope you wont take my advice too serious, since it might not be good (yet). Still, I hope you can follow my journey with some entertainment, and maybe one day, I will be one of those guys, like Buffet. Or at least 1/100 of that, still high enough to make a living from this.

This is just reflections of an asset manager.

Laztum

Leave a Reply