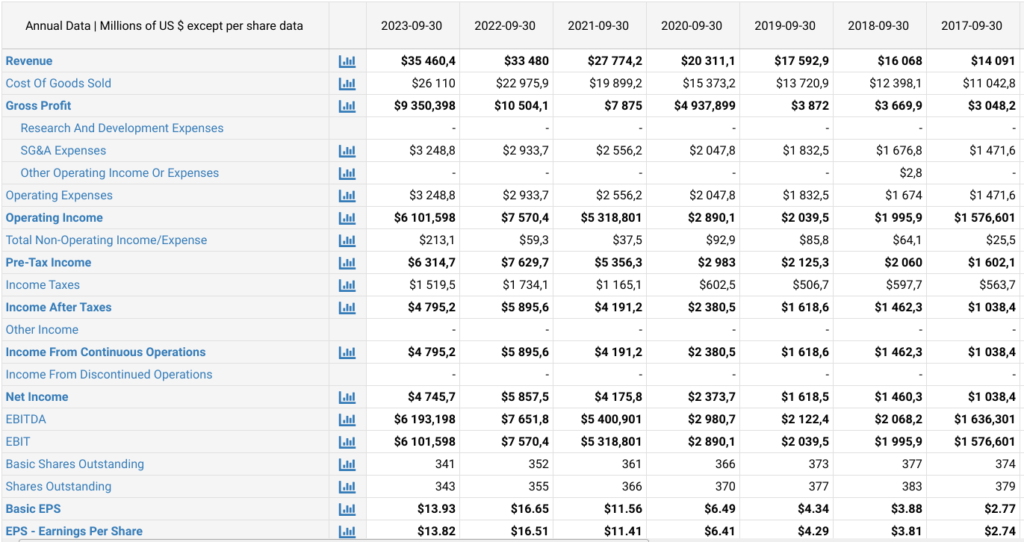

I bought Horton! Horton is the biggest homebuilder in the US. Currently selling at 11x p/e, averaging ROE 20~% since 2017 and growing both EPS and revenue steadily.

I think its a great business at a good price.

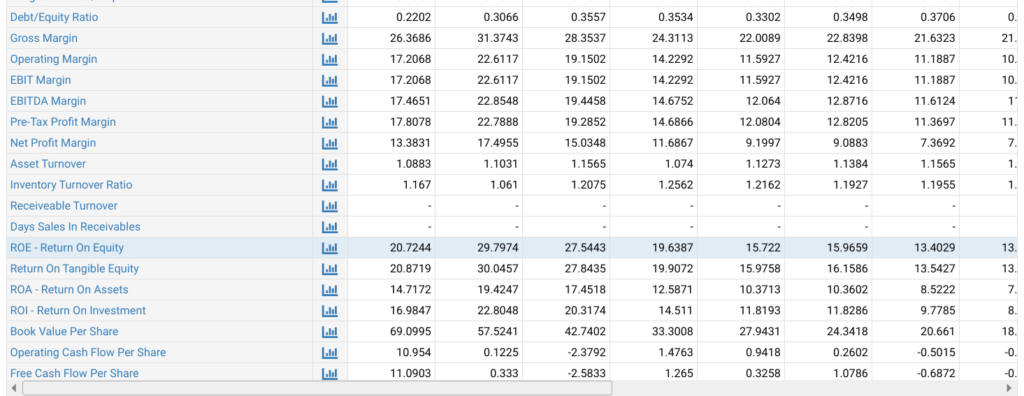

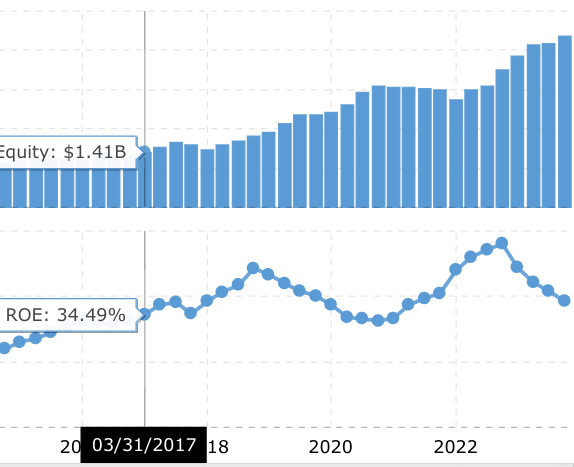

Here is a pic of their ROE. Check the grey highlighted line.

If you could get 11x p/e from 20% compounders, I want you to let me know. They really are not easy to find. Lucky for you mr. reader, you can regularly pop into my blog to see the hottest new stuff.

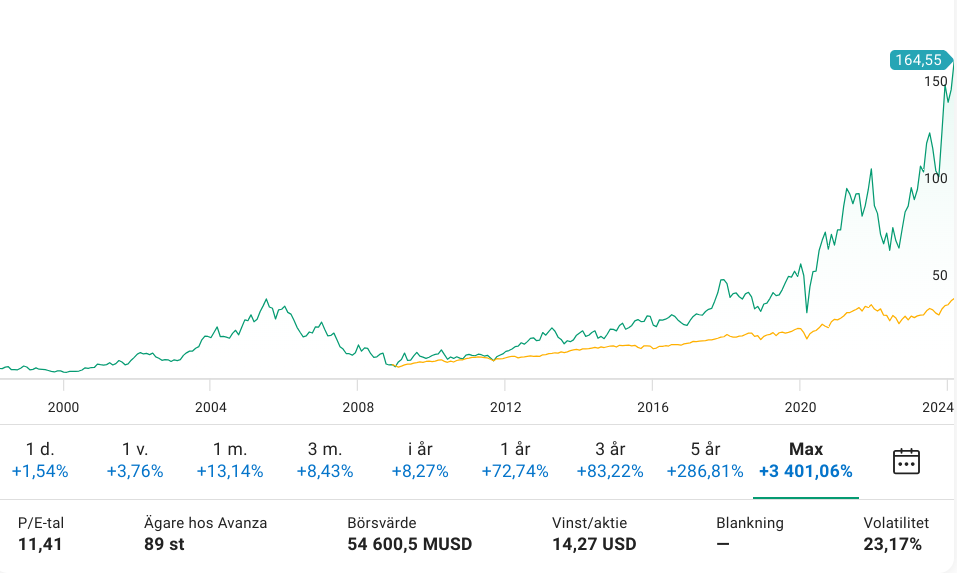

Anyway, since 2017, US home builders started switching from a “buying land and developing” to “borrowing land and selling houses” strategy, copying NVR. The more fancy term for this would be switching to an “asset light strategy”. Instead of buying land and then building homes on top of said land, home builders have realized that if we do not need to buy land… Our return on invested capital can be much higher! To be honest, I think the home builder industry has been super slow on this, especially since NVR, has been doing this since 08 at great success. And it really is not that hard to copy.

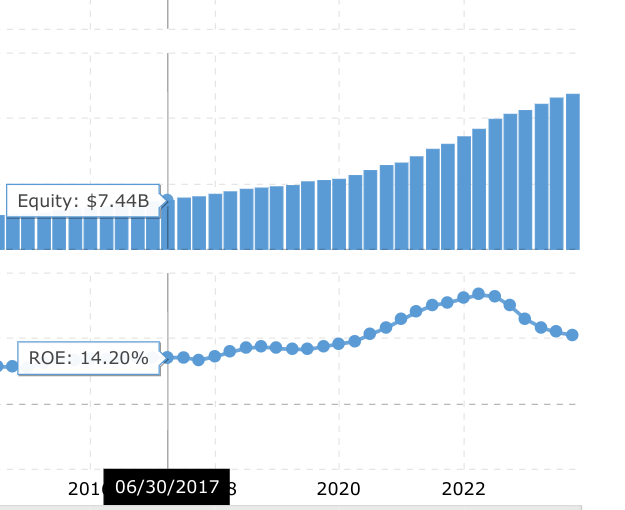

The NVR effect magic formula

Pretty decent returns if you ask me.

Basically, optioning instead of buying land plots, and building the house upon someone else’s land, frees up capital and improves ROI greatly. It lets homebuilders use all that capital… To build homes… Instead of buying land. Making them more “home building” and less “land owners”. Since land costs are often quite great, and they do not compound that well, maybe at max 3-4%, home builders are generally in the middle between “normal companies” and “boring real estate owners”, bought at between p/e 6-12. I think, with the switch to asset light strategies, these homebuilders can significantly improve their ROE/ROI/ROA, making them worthy of the “normal company” status at p/e 15 and above.

NVR started this asset light concept way back in 08’, they are really the golden standard selling at 16x. You can easily see their success story and catch on to what Horton is trying to do now. Both Horton and Lennar, the two biggest homebuilders switched up their strategies in 2017.

This one below is Horton ROE.

In this graph you can pretty easily see that this strategy has quite direct impacts, and ROE just keeps on improving. Upon seeing this graph you might first be impressed about the steady rise, but then becoming worried about the decline afterwards. Honestly, it probably just has to do with current market situations and interest rates etc. Since we can do a quick comparison to NVR, and see that they are also following this pattern.

This one below is NVR ROE.

Now at this point you might think, well NVR still has better return on equity and is the “star player” in the field that they are trying to imitate. Why wouldn’t I just buy them? ROE 35% and 20% (Horton last quarter) is still quite a big difference.

I do agree that NVR is not a bad choice. But NVR is concentrated to two states and is smaller than Horton, also they sell at 16x while Horton sells at 11x. Horton is operational in almost all of US states and therefore can gain better EOS (economics of scale), since their bargaining power with suppliers etc is better. They are also more insulated to market risk, since a specific region wouldn’t affect them too much. ALSO, I believe Horton has more “improvements” to be made. NVR is a superstar, to be honest, they are already peak Messi. They will continue to perform and they will most probably do very well. But they are already at their peak… It is very very hard, to reach higher ROE, higher ROI, better S&G costs etc for NVR.. They are already maxed out so to say. But Horton… They still have many improvements. They are like.. Younger Messi. Although they are older and bigger, they are actually behind and just recently started implementing the asset light model. If Horton can continue to improve margins, SOE and ROE, they might become peak Messi.

So summary wise… I think the potential returns for Horton, are higher. The potential.. Is bigger. I also think the risk, is lower. Since the expectations are set low. They are “expected” to be 50% worse than NVR at current prices. I do not think that they are that. So although I think all homebuilders (Horton, Lennar and NVR) are all interesting, I am going with Horton, since I believe the risk-adjusted return is best there out of the three.

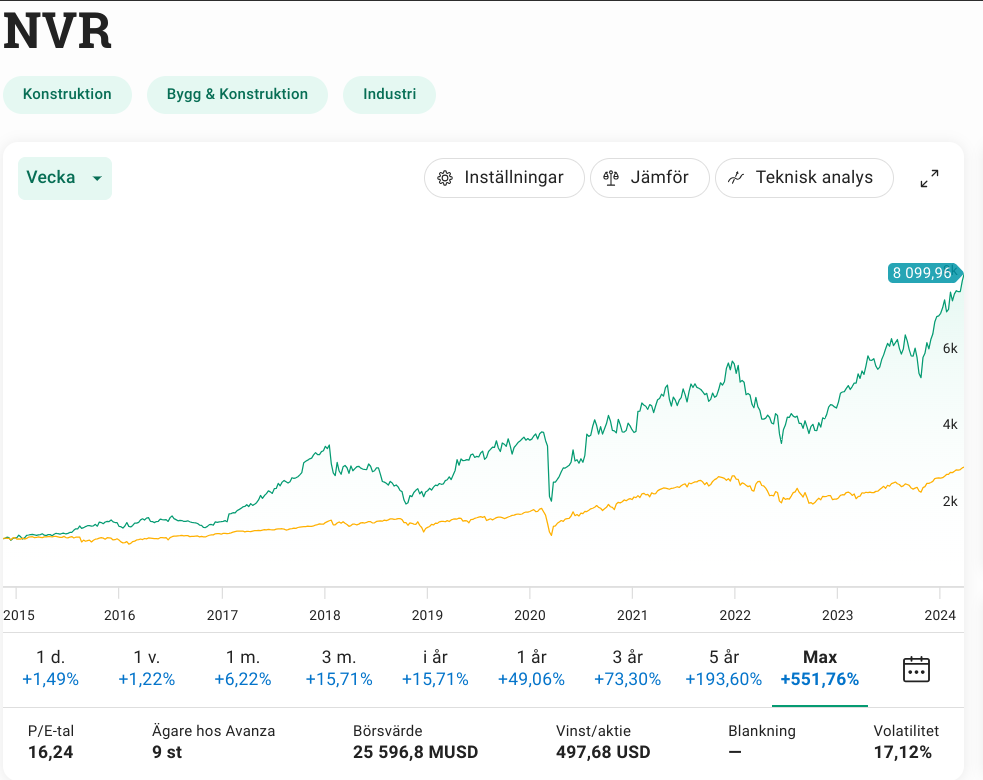

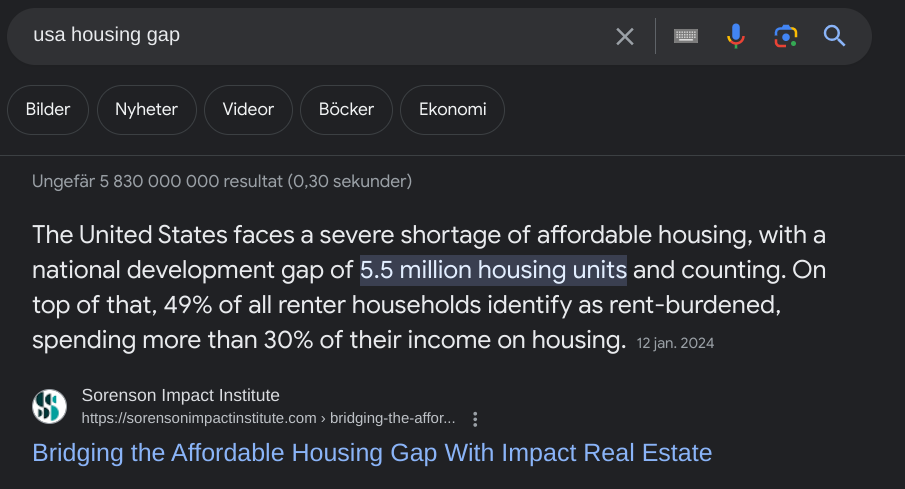

In the future, interest rates will most likely fall and production will keep scaling up. Although 2023 was “bad” for Horton compared to 2022, they still sold/ built more houses than the previous year. So the company and it’s operations, are growing steadily, we are just seeing a fall out in numbers because many things influence the margins like personell cost (S&G), material costs and of course, consumer apetite (interest rates). I think, with such a big gap in houses that we have today (3-4mn houses in US), Horton, NVR and Lennar becomes “inevitables”. It is just a matter of time. The US needs houses. And this could be the situation for an entire decade still, until that gap is filled properly.

So to summarize..

Home building has not historically been a high compounding industry because of the high impairment of capital when buying land, but with the asset light models this isnt the case anymore. Besides the US home market is underbuilt around 3-4 million homes and expanding production isnt as easy as flipping a switch, especially for bigger projects like building homes.

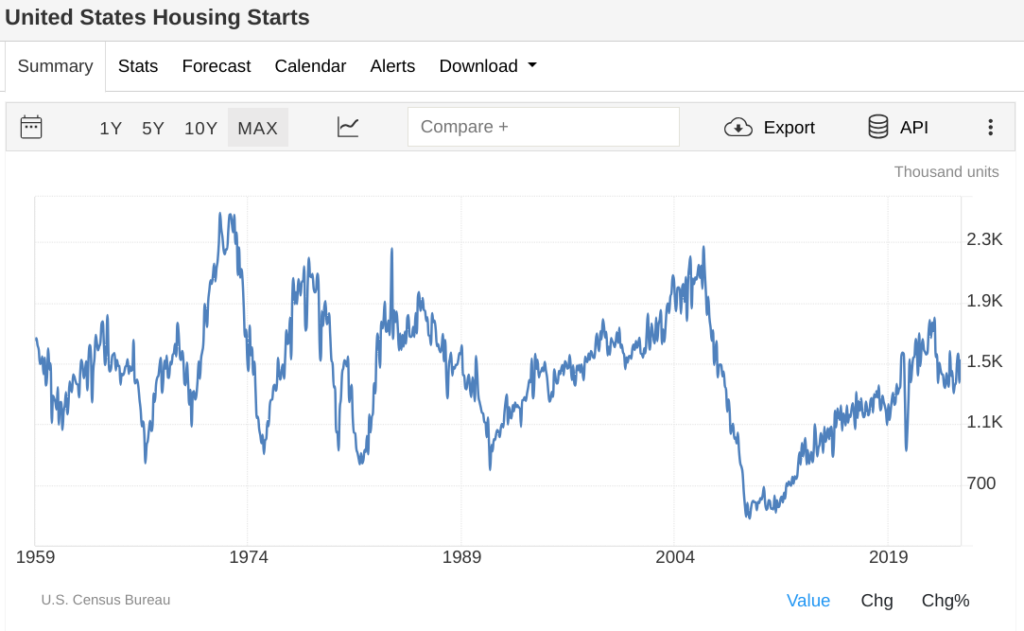

In general since 1980, US builds around 1.5mn houses a year on average to supply the demand of new US families. Since 08’, US homebuilding production has not reached demand creating this 3-4mn gap I mentioned earlier. Only recently has production ramped up to match demand and will have to go way higher to completely fill it. See picture.

So the gap might be growing slightly still, becuase of wreckage and similiar. But certainly, it is far from being filled in. So homebuilders have a great segway for the next decade, to build more and more houses. Insider ownership is decently high too at around 2~% across the board. And Dr. Horton himself is still Chairman of Board. ROE has steadily been rising since 2017 from 12/15%-30% up until last year 2023 where it “came down to” 21%. When homebuilders had to suffer a bit due to rising interest rates and so on leading to less construction. Imo, its a great long term play. Until we reach another 08 bubble that is, or the housing gap is filled, but its gonna be a long time until that and when interest rates fall construction will go hypersonic.

Housing Gap:

In general I distrust news outlets, well, to almost all regards. But market conditions are generally pretty accurate, although I am careful to not be coloured by language. 7 million may sound a lot, and it’s not an underwhelming amount by any means, but it isn’t “impossible” levels to achieve. Still, the “good run” of homebuilders is not yet finished. So I plan to ride the wave until we get there.

So you can get a 20% compounder… Maybe even better than that. At 11x price. This is a company that could and this is my take, probably will outperform Apple for example, that is selling at 11x compared to Apple’s 30 something. They also started doing share buyback properly in 2017 I think and today they yield in total should be around 2% (buybacks + dividend). Hopefully buybacks become even more agressive, since the balance sheet is starting to get pretty pristine (Horton could pay all their loans tomorrow if they wanted to and be debt-free). Honestly, I wouldn’t dislike that, I just like a nice looking “0” on the “long term liabilities” field, although I agree it’s not the best use of capital. But still, if I was in control, I would flex it and do it, I dont care (lol).

Hmmm. I might add something more as a follow up, but so far. It seems pretty “no brainer” to me.

Peace out.

Leave a Reply