Litha is an interesting one. When I was sweeping through datorama looking at some superinvestor portfolios, I noticed a couple of companies sticking out to me. The automotive dealership industry had oddly high concentration. So I decided to check it out.

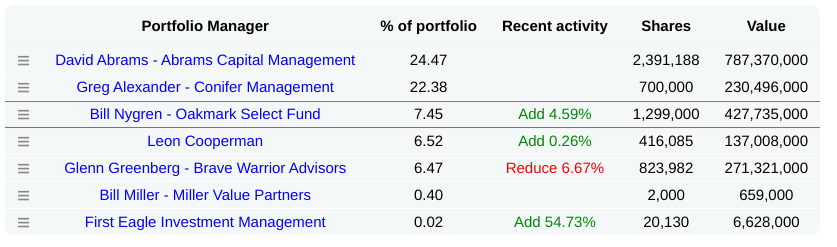

Lithia (LAD) ownership is quite high amongst plentiful of superinvestors, particularly David Abrams, Greg Alexander and Bill Nygren. See picture.

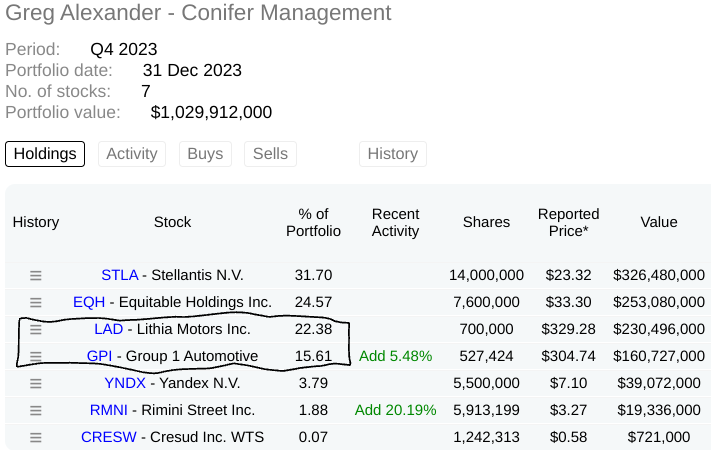

Some investors like Greg Alexander even have other automative bussinesses that have the same strategy like LAD, for example Group 1. See picture.

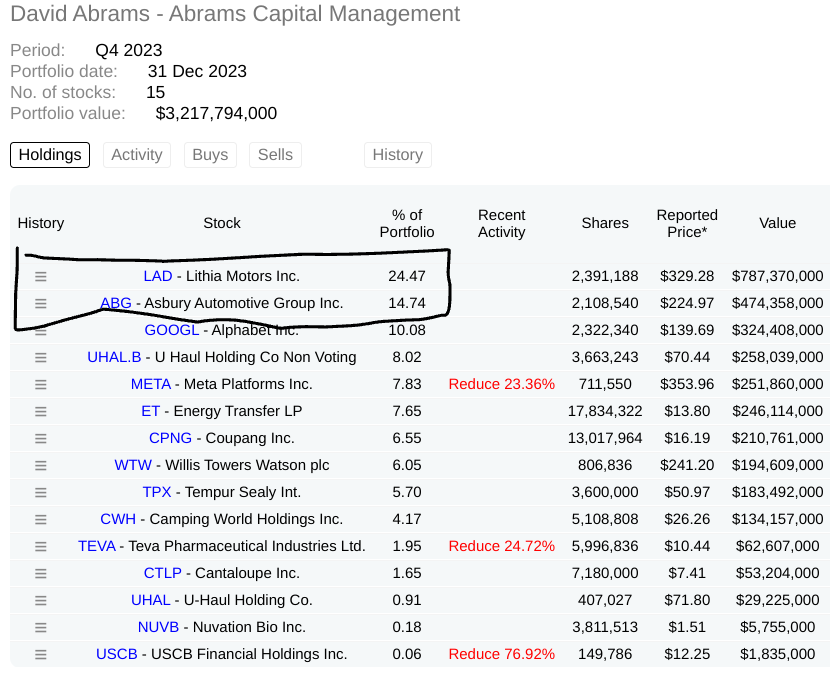

Greg Alexander, in his 1 billion dollar portfolio, has 400 of those 1000 million, solely in this automotive business. (Group 1 and LAD do the same thing, we will get into that later.) And he is not alone, David Abrams has done a similiar thing, but instead of GPI he has added Asburry Automotive as a diversification to the automotive market. See picture.

Seeing these heavy concentrations it piqued my interest to do some digging into this industry. What is actually so good about it? What do they do?

The industry is about buying cars from manufacturers, customers etc. Efficiently storing them, reselling them and servicing/repairing them. But that’s only scracthing the surface and frankly speaking, selling used cars, new cars and servicing them, is not what this business is about.

What is this business about? This business, is about efficient capital allocation. LAD, Asburry, GPI and the other top 10 businesses are broadly speaking in the business of handling car dealerships, but more specifically, they are in the business of buying/aquiring said car dealerships. And what is so special about that?

For some reason, these car dealerships continue to be sold at serious discounts creating a situation, where these “dealership investors” like LAD, can buy up discounted dealerships with great crashflow, to create mouth watering returns on investments. These automative dealership investors, are therefore in the business of serial aquisitions. The best company, is the company who can invest their capital to the best rate of returns.

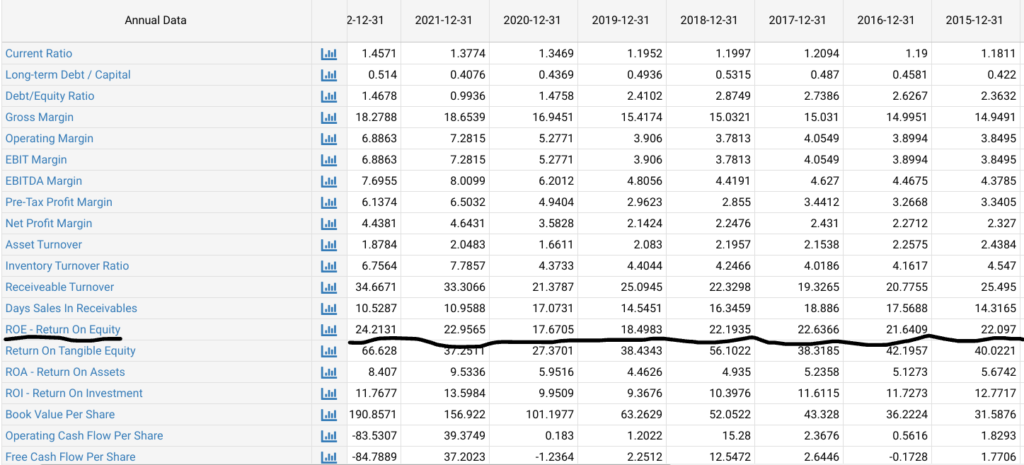

Taking a quick look at LAD ROE% we can quickly see that this company is well run. See picture.

Clearly, these are great numbers. ROE has been around 20% since 2015, a solid track record of great capital allocation. ROE is one of my favourite metrics, since a company can be greatly profitable, but not necessarily translating that wealth into the hands of the shareholders. ROE tells us that story and often, not always, give us a good picture into how “well treated” we are.

ROI, which you can see some lines underneath the ROE, is around 10% in general. Which tells us that the returns that LAD generate with their own invested capital into these dealership aquisitions is about 10-12%, but us as investors investing in LAD, generate around 20% on LAD. Meaning, that LAD is incredibly well run, where the business in itself adds value to our returns perhaps to us as shareholders, but certainly also to the businesses they invest in and aquire. This, is the core of the investment thesis to why to buy automative serial aquirers, which is in my opinion a more apt. description of these “automative dealers”.

First we concluded that a lot of supersmart people are buying this industry, then we saw the impressive returns on capital and understood why said investors would want a stake in this industry. The following question then becomes, why can they generate such impressive returns? And what is truly the competetive edge here? Why are dealerships… So cheap? Let me try to break it down.

Dealerships are heavily regulated, needing OEM (Original Equipment Manufacturers) licenses, car manufacture connections and industry know how to operate. The first one especially (OEM licensing) is very hard to aquire and the OEM licensers, have been and still are, incredibly picky with who they supply these licenses to. Generally, they require the dealership to have a long and trustworthy track record and demand previous experience in servicing, dealership experience etc. This means, that if you do not have OEM connections and you do not have said license to service, for example Toyota’s, then you could not be recognized by Toyota as being able to service Toyota’s. Basically, the people that do have the licenses are either specific individual dealerships, or big and somewhat older conglomerates, that have them all (like Lithia). And if you were just some random PE firm, how would you go about aquiring these OEM licenses, if you now decided to buy one of these discounted dealerships? And, “a-h-a“, that’s why there are serious discounts to automotive deaperships. Because big money, like PE firms (Private Equity), banks and big investors can’t enter it!

Even Warren Buffet tried to enter this market, but failed to aquire necessary licenses. If you don’t believe my just google Bershire Hathaway Automotives and you will quickly discover what I am talking about. And even Warren Buffet himself, was not able to turn BHA into the kind of serial aquirer that LAD is. So.. If Warren can’t… Im pretty confident, that nobody else will be able to. (I am talking about other big time money managers.) So big money, can not, even though they want to, enter this discounted yummy yum yum market. Leaving it all.. To LAD and their buddy buddies.

So basically, this creates a severe entry barrier into buying automative dealerships, preventing most PE firms from entering the industry profitably. Since PE is practically, (not legally) barred from buying dealerships, demand for buying said dealerships are of course lower. Meaning that companies within the sphere, can buy dealerships at really good prices, for goot returns on investment. This has been the case for a long time, and will probably continue to be the case.

Our reasoning continues, with understanding the competetive edge. We now move onto the market itself and understanding, how much more LAD can grow and how big the market actually is.

In general dealerships are mostly comprised of small owners, family owners or similiar and the industry is incredibly fragmented, with the top 10 car dealerships owning less than 10% of the market. That should give you a clear image of the potential for continued expansion for not only LAD, but the rest of the top 10 car dealerships. So I won’t expand on it. Because the math is stupid and unecessary. Let’s instead talk about the competition.

Amongst these ’automotive dealership bargain hunters’ we have Autonation, Penske, Group 1, Asbury and of course Lithia motors. They all look pretty good to me, but Lithia has a few things the others lack in some proportions. (But I think Group 1 and Asburry are both valid choices, personally I had a hard time deciding between Asburry and Lithia, but landed on LAD in the end.)

1. Family driven business

Boer’s family has founded and driven this business for 2 generations now. I love family businesses. A family owned and founded company has a certain love and care, that can’t be replicated by a skilled paid worker. Meaning, as a shareholder, you join this family, and therefore often get treated way better, than the alternatives.

2. Serious consistency

Lithia has some serious consistency. It is consistent in 15%+ ROE, consistent in aquiring and improving the business, consistent in money management and growth. The other competitors are not as consistent, and it has definitely shown in the numbers. Asburry has seen the most explosive growth, but their consistency and shareholder alignments make me slightly worried about the risks it could face with a change in management.

3. The superinvestors favourite

Most superinvestors agree, that LAD is the best, which is reflected in their holdings. Although some own GPI and some own Asburry, most of them own LAD. I do think the reason is because of a mix of quality, but also of price. The other competitors on the market simply lack one or the other. I am a big quality guy, so I landed on Asburry or LAD pretty quickly. But between them it gets a little hard, but LAD definitely has a better price than Asburry and I think that may sway many investors. In my personal opinion, I think LAD is the de facto best in the industry from a risk adjusted returns perspective. From a raw returns perspective, Asburry might be better. So if you are more into higher returns higher risk, you can check them out. But I think there is a consistent value idea in the fact that most superinvestors own LAD, because right now, they offer the best Value for Price mix in this industry.

4. It seems hardest to fail

Looking at the risk aspect of things, I think Lithia is the most consistent and compact amongst them. This point is kinda like number 2. serious consistency, but I really want to make this a key aspect that separates Lithia from Asburry and the rest. I just find it hard to see a scenario, that Lithia would not perform well. The risk just seems incredibly low for the price right now.

Basically, Lithia is in my opinion, best, smartest, most competent and hardest working. I just think straight up, that today, and as far as I can see, they are the best in the business.

They have national coverage, a large and sofisticated supply network throughout the US and the necessary licenses and know how. Today they operate around 300 dealerships, the total dealerships in the us amount to around 17 000, and the total Lithia may go up to and are looking at, are around 2500~ (that’s 8x if it plays out). Lithia can still add on a lot of meat, before they reach maturity, and with a decade of proven skillset, im looking at a decade of solid growth. Thats the idea.

Now let’s talk some about potential risks. EV cars are one thing that can upset this idea. Today EV cars in circulation represent 1% of total cars in the US. This is going to go up certainly, but hopefully not enough to off set Lithia motors investment idea. The fear here is that electric cars in general require less servicing and repairs than ’normal’ engines and cars. Making a dent in earnings for many dealerships. Also, some electrical manufacturers like Tesla and Rivian bypass dealerships and sell directly to consumers, creating yet another dent in the earnings power of dealerships. This is certainly a trend that needs to be monitored, yet, I am not so afraid of this scenario playing it, since I do not identify it as a threat until it reaches critical mass.

Now let’s talk valuation. Today Lithia can be bought at 280 dollars on the stock. EPS is worth imo around 30-35, which means u can buy this company for under 10 P/E. Which is crazy good. Im still eying the price, to see if I can get in at >250, that would be… Mouth watering. Nonetheless, todays price suffices as a bargain, for the coming decade as an investment. So I have a small position today but looking to expand it if valuations get better somehow. Either with business expansion or price decline. Either works for me.

Im just leaving my recommendation out here in the vast wide internet, so I can see how I performed in 5 years.

Good hunting.

Leave a Reply