Over the last few years Avanza has been one of my favourite companies to own. It is a firm with a great past, present and future.

Summarizing, Avanza is a swedish bank, finding a nische within the market as a user friendly discount broker. They have an incredible management team, mainly due to the chairman Hagströmer and family (~20% insider ownership), that ensures value for shareholders. Avanza as a business and product, also maintains significant competetive edges, being more user friendly and cheaper than the alternative (traditional big banks). For the last decade, they have enjoyed a steadily rising ROE of 20-40%. Simply incredible numbers.

I have personal experience with Avanza and I regularly hear of people switching from the major big banks to Avanza (I used to work as customer service at one of Sweden’s big banks). Avanza are smaller than the ’established/ traditional players’ and can therefore adapt faster to the enviroment and be nimbler than the traditional banks. Good initiatives for example are “free index funds” like Avanza Zero and Avanza consistently offering a 0.2-0.4% higher interest rate for saving accounts to draw in investors. Avanza also continues to impress with basically no queue to customer service, an “on demand” line directly to whatever help you would need from them as a customer. This is a stark contrast to the traditional banks, where you can be expected to wait 20-30 minutes on average.

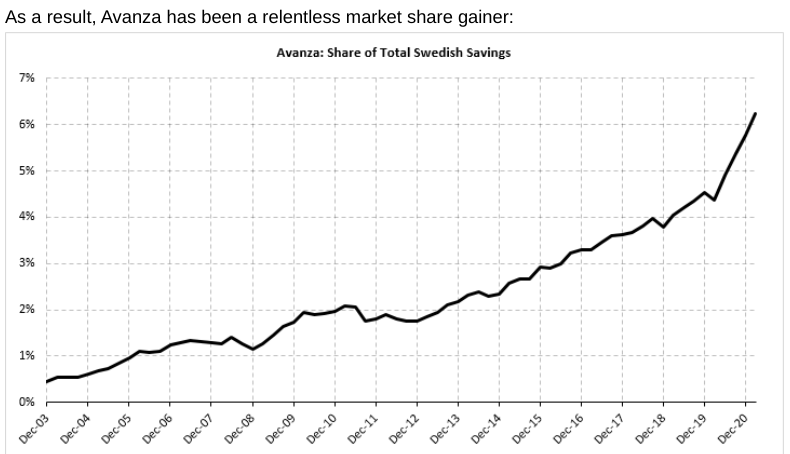

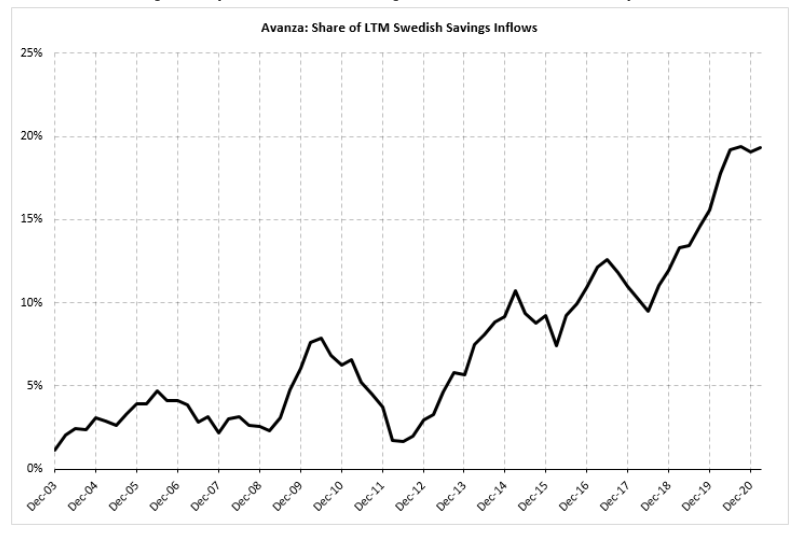

Although Avanza accounts only for 6% of market share, up to 20% of swedish savings inflows have recently went to Avanza. This paints a clear picture of Avanza’s future potential.

They have been gaining market share for ~15 yrs and they are still going strong. The median age in Sweden is 47 and the median ’avanzian’ is 35. This speaks to the ~10yrs of growth still ahead of them. Most people on Avanza are people such as me, 20-30 years old. In 10 years, we will be 30-40 years old. Young people who get started in investing consistently choose Avanza over other alternatives.

If you are asking why old people do not switch, that is quite simple. Once you stuck with one you will probably stay sticking with that one almost your entire life. Unless you are very financially concientious, which most people just are not.

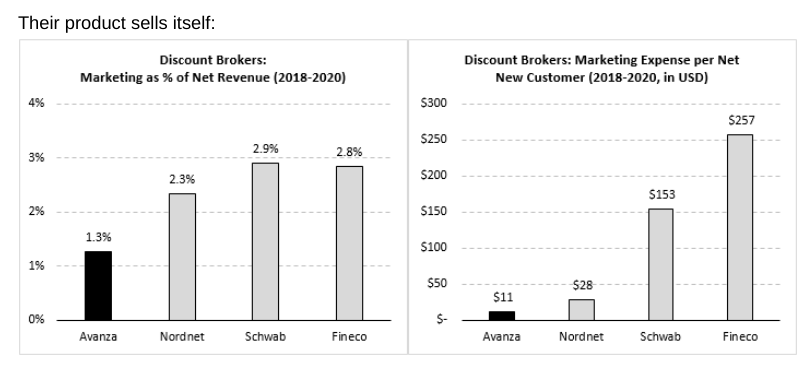

Avanza also has efficiency ratios that are through the roof. And a good example are the marketing expenses. A product and a company is not necessarily strong just because it sells a lot, it becomes strong because it is profitable. And Avanza, has the most profitable product on the market. It might not grow the fastest or be the most advanced, but for many reasons, it is the most profitable amongst it’s competitors.

Recently Avanza guided for international expansion before 2030, which is something I am slightly worried about but also see potential in. So we will see how it goes, I trust in management to not make hasty decisions.

About risks, Hagströmer passing is definitely one. He is currently 80 years old and has been at the forefront of strategical directives since inception. He is a key person. His son, around 45 years old, is currently also on the board with ~10 years experience. I trust, that Hagströmer has made good plans for his possible retirement or passing. Either way, the product of Avanza is very strong and the culture that has been instilled is also. Even an idiot can run Avanza, it is not a revolutionary in any way. Simply being cheaper and more user friendly.

The major banks they are competing against, are lazy. Fat and bloated, inefficient and undisciplined. They enjoy such great priviligies in the oligarchy that has taken hold of Swedish banking, that they are no longer run by the shareholders, instead by institutions, the state and public opinion. They are greatly inefficient. I know this well from working at such places for 2 years. That is why as a shareholder, Avanza will never be beaten. If Hagströmer and family sold all vested shares, I would become increasingly alarmed. But I see that as a very low risk variable not really worthy of speculation.

Avanza, is for me, a ‘Super Company‘. Good management, insider ownership, highly profitable product, lean and efficient operations but most of all, an incredibly durable competetive edge that, if execution continues well, shall not be made blunt. There needs to be yearly check-ins made as an investor, but seeing how the company is structured, not more than that.

Hope you enjoyed this investment idea.

Laztum.

Leave a Reply